Doors

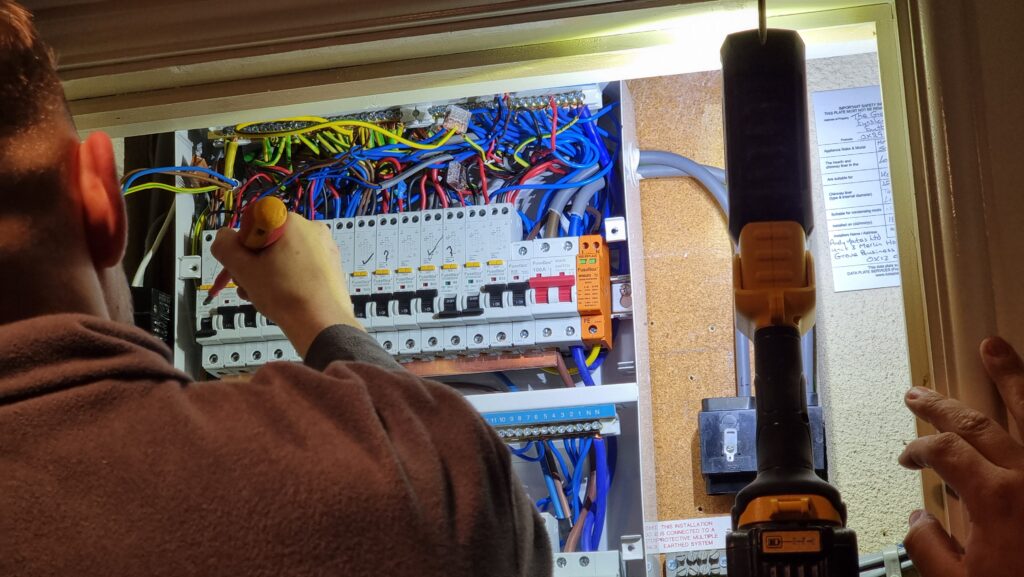

As our house rennovations/attic conversions come to a close, I found myself up in what will soon become my en suite, fitting a mirror, towel rail, and other accessories.

Wanting to minimise how much my power tool usage disturbed the rest of the house, I went to close the door separating my new bedroom from my rest of my house, only to find that it didn’t properly fit its frame and instead jammed part-way-closed.

Somehow we’d never tested that this door closed properly before we paid the final instalment to the fitters. And while I’m sure they’d have come back to repair the problem if I asked, I figured that it’d be faster and more-satisfying to fix it for myself.

Homes

As a result of an extension – constructed long before we moved in – the house in Preston in which spent much of my childhood had not just a front and a back door but what we called the “side door”, which connected the kitchen to the driveway.

Unfortunately the door that was installed as the “side door” was really designed for interior use and it suffered for every winter it faced the biting wet North wind.

My father’s DIY skills could be rated as somewhere between mediocre and catastrophic, but his desire to not spend money “frivolously” was strong, and so he never repaired nor replaced the troublesome door. Over the course of each year the wood would invariably absorb more and more water and swell until it became stiff and hard to open and close.

The solution: every time my grandfather would visit us, each Christmas, my dad would have his dad take down the door, plane an eighth of an inch or so off the bottom, and re-hang it.

Sometimes, as a child, I’d help him do so.

Planes

The first thing to do when repairing a badly-fitting door is work out exactly where it’s sticking. I borrowed a wax crayon from the kids’ art supplies, coloured the edge of the door, and opened and closed it a few times (as far as possible) to spot where the marks had smudged.

Fortunately my new bedroom door was only sticking along the top edge, so I could get by without unmounting it so long as I could brace it in place. I lugged a heavy fence post rammer from the garage and used it to brace the door in place, then climbed a stepladder to comfortably reach the top.

Loss

After my paternal grandfather died, there was nobody left who would attend to the side door of our house. Each year, it became a little stiffer, until one day it wouldn’t open at all.

Surely this would be the point at which he’d pry open his wallet and pay for it to be replaced?

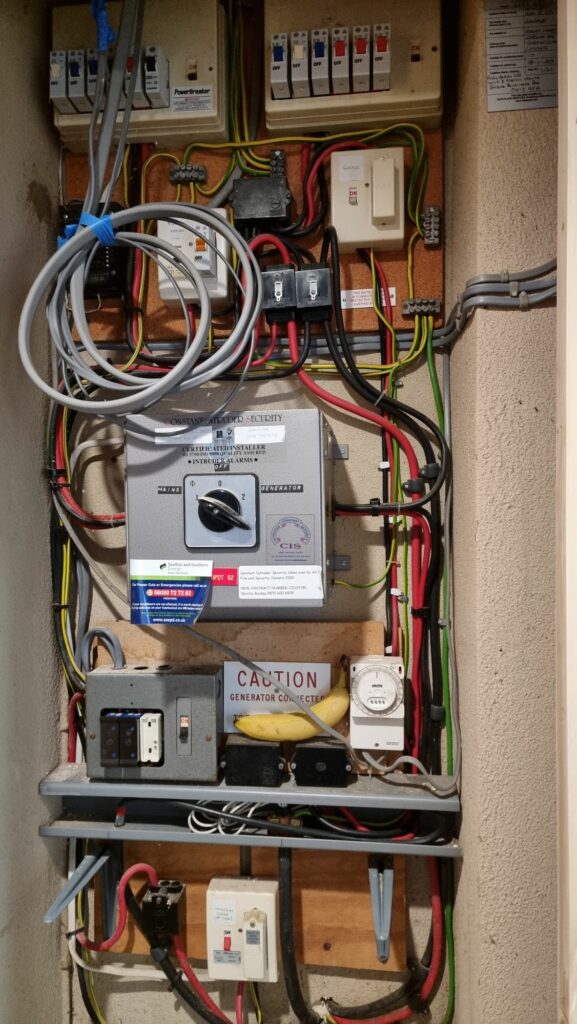

Nope. Instead, he inexpertly screwed a skirting board to it and declared that it was now no-longer a door, but a wall.

I suppose from a functionalist perspective he was correct, but it still takes a special level of boldness to simply say “That door? It’s a wall now.”

Sand

Of all the important tasks a carpenter (or in this case, DIY-er) must undertake, hand sanding must surely be the least-satisfying.

But reaching the end of the process, the feel of a freshly-planed, carefully-sanded piece of wood is fantastic. This surface represented chaos, and now it represents order. Order that you yourself have brought about.

Often, you’ll be the only one to know. When my grandfather would plane and sand the bottom edge of our house’s side door, he’d give it a treatment of oil (in a doomed-to-fail attempt to keep the moisture out) and then hang it again. Nobody can see its underside once it’s hung, and so his handiwork was invisible to anybody who hadn’t spent the last couple of months swearing at the stiffness of the door.

Even though the top of my door is visible – particularly visible, given its sloping face – nobody sees the result of the sanding because it’s hidden beneath a layer of paint.

A few brush strokes provide the final touch to a spot of DIY… that in provided a framing device for me to share a moment of nostalgia with you.

Sweep away the wood shavings. Keep the memories.